UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

SCHEDULE 14A

PROXY STATEMENT PURSUANT TO SECTION 14(A) OF THE

SECURITIES EXCHANGE ACT OF INFORMATION

Proxy Statement Pursuant to Section 14(a) of the Securities

Exchange Act of 1934

Filed by the Registrant x

Filed by a Party other than the Registrant¨

Check the appropriate box:

| o | Preliminary Proxy Statement |

| o | Confidential, |

| x | Definitive Proxy Statement |

| o | Definitive Additional Materials |

| o | Soliciting Material Pursuant to |

DOCUMENT SECURITY SYSTEMS, INC.

DOCUMENT SECURITY SYSTEMS, INC.

(Name of Registrant as Specified In Its Charter)

Payment of Filing Fee (Check the appropriate box):

| x | No fee | ||

| o | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. | ||

| (1) | Title of each class of securities to which transaction applies: |

| (2) | Aggregate number of securities to which transaction applies: |

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 |

| (4) | Proposed maximum aggregate value of transaction: |

| (5) | Total fee paid: |

| o | Fee paid previously with preliminary materials. | ||

| o | Check box if any part of the fee is offset as provided by Exchange Act Rule | ||

| (1) | Amount Previously Paid: |

| (2) | Form, Schedule or Registration Statement No.: |

| (3) | Filing Party: |

| (4) | Date Filed: |

DOCUMENT SECURITY SYSTEMS, INC.

28 EAST MAIN STREET, SUITE 1525

ROCHESTER, NEW YORK 14614

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

Rochester, New YorkApril 18, 2012

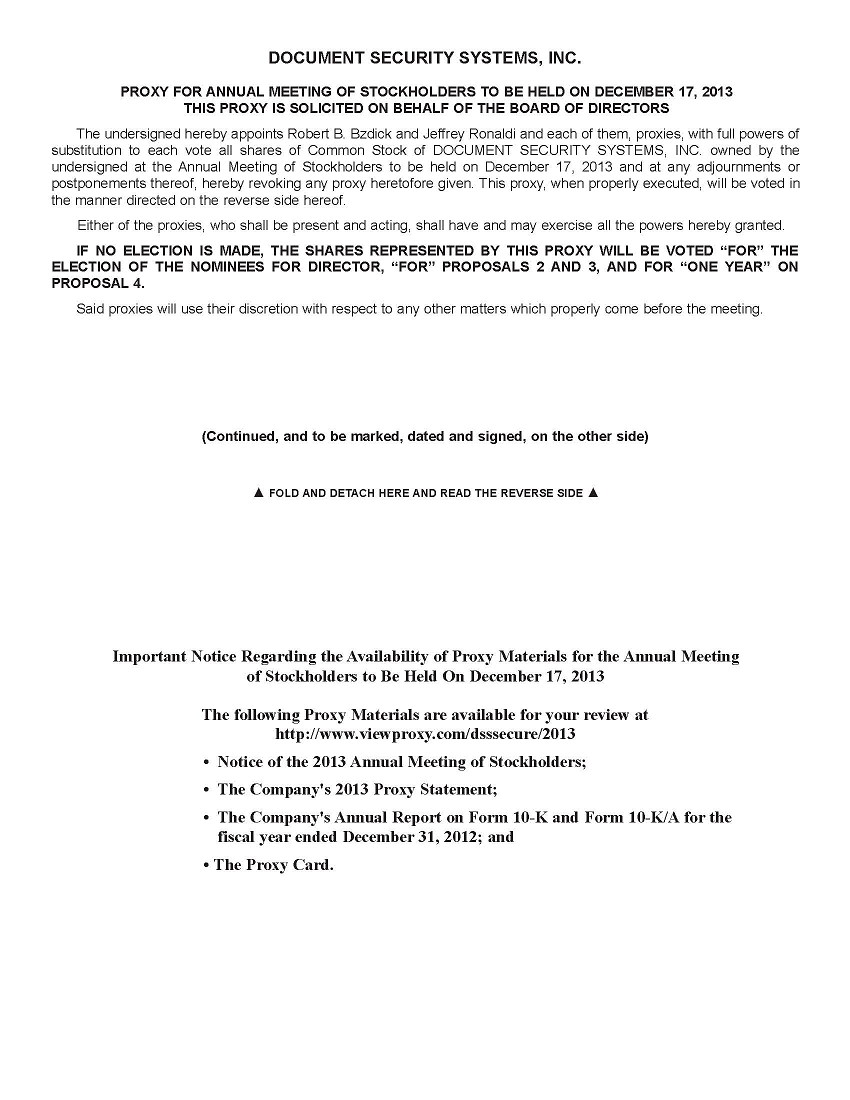

The Annual Meeting of Stockholders (the “Annual Meeting”) of Document Security Systems, Inc. (the “Company”, “we”, “us” or “our”) will be held on Thursday, June 14, 2012,Tuesday, December 17, 2013, at 11:00 a.m. (Eastern Standard Time) at the Hyatt Regency Rochester, 125 East Main Street, Rochester, New York 14604 for the purposes of:

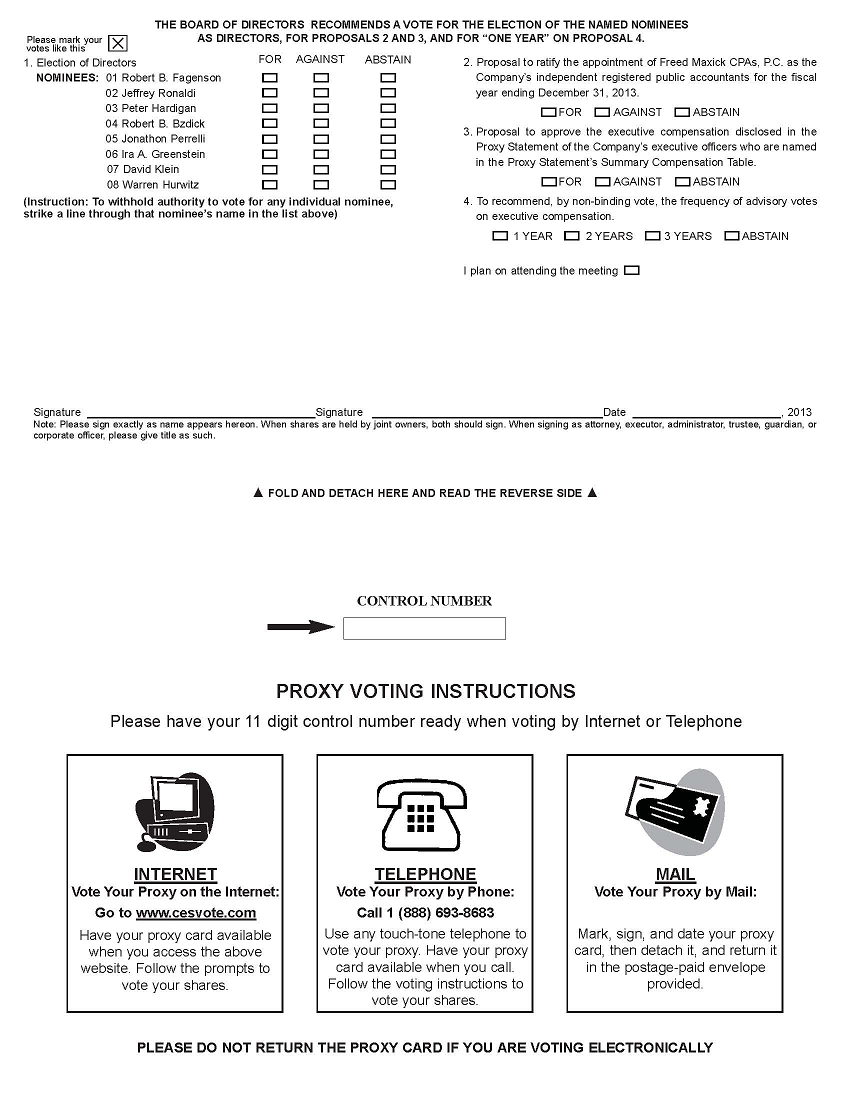

| 1. | Considering and voting upon a proposal to elect eight directors to the Company’s Board of Directors to hold office until the next Annual Meeting; |

| 2. | Considering and voting upon a proposal to ratify Freed Maxick CPAs, P.C. as the Company’s independent registered public accountants for the fiscal year ending December 31, |

| 3. |

| 4. |

| 5. |

The foregoing items of business are more fully described in the Proxy Statement accompanying this notice.

The Board of Directors has fixed the close of business on April 17, 2012October 24, 2013 as the record date (the “Record Date”) for the determination of stockholders entitled to notice of, and to vote at, the Annual Meeting and at any adjournment or postponement thereof.

This year, we are again implementing the “Notice and Access” method approved by the Securities and Exchange Commission that allows companies to provide proxy materials to stockholders via the Internet. The Internet will be used as our primary means of furnishing proxy materials to our stockholders. Consequently, most stockholders will not receive paper copies of our proxy materials. We will instead send stockholders a notice with instructions for accessing the proxy materials and voting via the Internet. The notice also provides information on how stockholders may obtain paper copies of our proxy materials if they so choose. This makes the proxy distribution process more efficient and less costly.

We will mail our stockholders of record by the close of business on May 4, 2012November 7, 2013 a Notice of Internet Availability of Proxy Materials (the “Notice”), which contains specific instructions on how to access those materials via the Internet and vote online, as well as instructions on how to request paper copies. The Company’s Annual Report and the Proxy Statement, along with any amendments to the foregoing materials that are required to be furnished to stockholders, will be available atwww.amstock.com/proxyservices/viewmaterial.asp?CoNumber=11989. http://viewproxy.com/dsssecure/2013.

| By | |||||

![[GRAPHIC MISSING]](https://capedge.com/proxy/DEF 14A/0001144204-13-057429/image_001.jpg) | |||||

| Robert Fagenson Chairman of the Board | |||||

| 2 |

WHETHER OR NOT YOU PLAN ON ATTENDING THE ANNUAL MEETING IN PERSON, PLEASE VOTE AS PROMPTLY AS POSSIBLE TO ENSURE THAT YOUR VOTE IS COUNTED.

THE PROPOSALPROPOSALS FOR THE ELECTION OF DIRECTORS, ISTHE ADVISORY VOTE ON EXECUTIVE COMPENSATION, AND THE ADVISORY VOTE ON THE FREQUENCY OF FUTURE ADVISORY VOTES ON EXECUTIVE COMPENSATION ARE CONSIDERED A “NON-ROUTINE” MATTER.MATTERS. ACCORDINGLY, BROKERS, BANKS, BROKER DEALERS AND OTHER NOMINEES ARE NOT PERMITTED TO VOTE ON ELECTION OF DIRECTORSTHESE MATTERS WITHOUT SPECIFIC VOTING INSTRUCTIONS FROM THE BENEFICIAL OWNER.

THE PROPOSAL FOR THE EXTENSION OF THE TERM AND THE INCREASE IN THE NUMBER OF SHARES AVAILABLE UNDER THE EMPLOYEE PLAN IS CONSIDERED A “NON-ROUTINE” MATTER. ACCORDINGLY, BROKERS, BANKS, BROKER DEALERS AND OTHER NOMINEES ARE NOT PERMITTED TO VOTE ON SUCH EXTENSION OR INCREASE IN SHARES WITHOUT SPECIFIC VOTING INSTRUCTIONS FROM THE BENEFICIAL OWNER.

THE PROPOSAL FOR THE EXTENSION OF THE TERM, ADDITIONAL OPTION GRANTS BASED ON DIRECTOR TENURE, DISCRETIONARY RESTRICTED STOCK GRANTS, AND THE INCREASE IN THE NUMBER OF SHARES AVAILABLE UNDER THE DIRECTOR PLAN IS CONSIDERED A “NON-ROUTINE” MATTER. ACCORDINGLY, BROKERS, BANKS, BROKER DEALERS AND OTHER NOMINEES ARE NOT PERMITTED TO VOTE ON SUCH EXTENSION, ADDITIONAL OPTION GRANTS, DISCRETIONARY RESTRICTED STOCK GRANTS, OR INCREASE IN SHARES WITHOUT SPECIFIC VOTING INSTRUCTIONS FROM THE BENEFICIAL OWNER.

DOCUMENT SECURITY SYSTEMS, INC.

28 EAST MAIN STREET, SUITE 1525

ROCHESTER, NEW YORK 14614

_____________________

PROXY STATEMENT FOR THE COMPANY’S

ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD ON JUNE 14, 2012

DECEMBER 17, 2013

QUESTIONS AND ANSWERS ABOUT THESE PROXY MATERIALS

Why am I receiving these proxy materials?

The proxy materials describe the proposals on which our Board of Directors would like you, as a stockholder, to vote in favor ofon at the Annual Meeting. The materials provide you with information on these proposals so that you can make an informed decision. We intend to mail a Notice of Internet Availability of Proxy Materials (the “Notice”) to all stockholders of record entitled to vote at the Annual Meeting.

Who can vote at the Annual Meeting of Stockholders?

Stockholders who owned shares of common stock of the Company, par value $0.02 per share (the “Common Stock”), as of April 17, 2012,October 24, 2013, the Record Date, may attend and vote at the Annual Meeting. Each share is entitled to one vote. There were 20,738,80449,230,159 shares of Common Stock outstanding as of April 17, 2012.October 24, 2013. All shares of Common Stock shall vote together as a single class.

What is the proxy card?

The proxy card enables you to appoint the person or persons named therein as your representative to vote your shares at the Annual Meeting, and to provide specific instructions as to how you wish your shares to be voted. By completing and returning the proxy card, you are authorizing these persons to vote your shares at the Annual Meeting in accordance with your instructions on the proxy card. By providing specific voting instructions for each proposal identified on the proxy card, your shares will be voted in accordance with your wishes whether or not you attend the Annual Meeting. Even if you plan to attend the Annual Meeting, we suggest that you complete and return your proxy card before the Annual Meeting date just in case your plans change. If a routine proposal comes up for vote at the Annual Meeting that is not on the proxy card, your appointed representative will vote your shares, under your proxy, according to their best judgment.

What am I voting on?

You are being asked to vote on the election of the Company’s Board of Directors, and on the ratification of the Company’s independent registered public accountants for the fiscal year ending December 31, 2012. You2013, for approval of executive compensation disclosed in this Proxy Statement of the Company’s executive officers who are also being asked to votenamed in this Proxy Statement’s Summary Compensation Table, and on the extensionfrequency of the terms of each of the Amended and Restated 2004 Employee Stock Option Plan (“Employee Plan”) and the Amended and Restated 2004 Non-Executive Director Stock Option Plan (“Director Plan”), as well as an increase in the number of shares under such Plans that may be issued to the Company’s employees and non-executive directors in the form of restricted stock or shares underlying options grants. Under the Director Plan, you are also being asked to votefuture advisory votes on the amendments permitting additional option grants to be made to directors based on director tenure, and permitting discretionary restricted stock grants to directors and advisors.executive compensation. We may also transact any other business that properly comes before the Annual Meeting.

How does the Board of Directors recommend that I vote?

Our Board of Directors unanimously recommends that the stockholders vote “For” the nominees for director, “For” the ratification of the Company’s independent registered public accountants for the fiscal year ending December 31, 2012,2013, “For” approval of the proposed amendmentsexecutive compensation disclosed in this Proxy Statement of the Company’s executive officers who are named in this Proxy Statement’s Summary Compensation Table, and for “one year” with respect to the Employee Plan, and “For” the proposed amendments to the Director Plan.frequency of advisory votes on executive compensation

What is the difference between holding shares as a stockholder of record and holding shares as a beneficial owner?

Most of our stockholders hold their shares in an account at a brokerage firm, bank, broker dealer or other nominee holder, rather than holding share certificates in their own name. As summarized below, there are some distinctions between shares held of record and those owned beneficially.

StockholderRegistered Stockholders (Stockholders of Record

Record)If on the Record Date, your shares were registered directly in your name with our transfer agent, American Stock Transfer and Trust Company, LLC (“AST”), you are a stockholder of record who may vote at the Annual Meeting. As the stockholder of record, you have the right to direct the voting of your shares by returning the enclosed proxy card to us or to vote in person at the Annual Meeting. Whether or not you plan to attend the Annual Meeting, please complete, date and sign the enclosed proxy card and provide specific voting instructions to ensure that your shares will be voted at the Annual Meeting.

Beneficial Owner

If on the Record Date, your shares were held in an account at a brokerage firm, bank, broker-dealer or other similar organization, you are considered the beneficial owner of shares held “in street name”, and the Notice is being forwarded to you by that organization. The organization holding your account is considered the shareholder of record for purposes of voting at the Annual Meeting. As the beneficial owner, you have the right to instruct your nominee holder on how to vote your shares and to attend the Annual Meeting. However, since you are not the stockholder of record, you may not vote these shares in person at the Annual Meeting unless you receive a valid proxy from your brokerage firm, bank, broker dealer or other nominee holder. To obtain a valid proxy, you must make a special request of your brokerage firm, bank, broker dealer or other nominee holder. If you do not make this request, you can still vote by following the voting instructions contained in the Notice; however, you will not be able to vote in person at the Annual Meeting. If you do not provide specific voting instructions to your nominee holder for each proposal identified on the proxy card, your nominee holder will only be permitted to cast a vote on Proposal 2, ratification of the Company’s independent registered public accountants, but will not be permitted to cast a vote in connection with Proposals 1, 3 or 4.

How do I Vote?

Stockholders of record (also called registered stockholders) may vote by any of the following methods:

A. By mail: if you request or receive proxy materials by mail, you may vote by completing the proxy card with your voting instructions and returning it in the postage-paid envelope provided.

If we receive your proxy card prior to the Annual Meeting date and you have marked your voting instructions on the proxy card, your shares will be voted:

| as you instruct, and |

| as your proxy representative may determine in their discretion with respect to any other matters properly presented for a vote at the Annual Meeting. |

If you return a signed proxy card, but do not provide specific voting instructions for each proposal, your shares will be voted by your proxy representative in the manner recommended by the Board on all matters presented in the Proxy Statement and as the proxy representatives may determine in their discretion with respect to any other matters properly presented for a vote at the Annual Meeting.

B. By Internet: read the proxy materials and follow the instructions provided in the Notice.

C. By toll-free telephone: read the proxy materials and call the toll free number provided for in the proxy voting instructions.

D. In person at the Annual Meeting.

Beneficial Stockholders (shares held in “street name”). If your shares are held in the name of a broker, bank, broker dealer or other nominee holder of record, follow the voting instructions you receive from the holder of record to vote your shares. You must provide specific voting instructions to your broker, bank, broker dealer or other nominee holder of record in order for your shares to be voted in the proposal for election of directors, or for the proposals relating to the amendments to eachapproval of the Employee Planexecutive compensation disclosed in this Proxy Statement of the Company’s executive officers who are named in this Proxy Statement’s Summary Compensation Table, and Director Plan.on the frequency of advisory votes on executive compensation. If you are a beneficial holder of shares held in street name and do not provide the organization that holds your shares with specific voting instructions, under the rules of various national and regional securities exchanges, the organization that holds your shares may generally vote on routine matters but cannot vote on non-routine matters. If the organization that holds your shares

share does not receive instructions from you on how to vote your shares on a non-routine matter, the organization that holds your shares will inform the inspector of election that it does not have the authority to vote on such non-routine matter with respect to your shares. This is generally referred to as a “broker non-vote”.

If you are a beneficial owner of shares held in street name, you may vote by any of the following methods:

A. By Mail: If you request or receive printed copies of the proxy materials by mail, you may vote by completing the proxy card with your voting instructions and returning it to your broker, bank, broker dealer or other nominee holder of record prior to the Annual Meeting.

B. By Internet. You may vote via the Internet by following the instructions provided in the Notice mailed to you by your nominee holder.

C. By toll-free telephone. You may vote by calling the toll free telephone number found in the proxy voting instructions.

D. In Person. If you are a beneficial owner of shares held in street name and you wish to vote in person at the Annual Meeting, you must obtain a valid proxy from the nominee organization that holds your shares.

Why did I receive a Notice in the mail regarding the Internet availability of proxy materials instead of a full set of proxy materials?

Pursuant to rules adopted by the Securities and Exchange Commission, the Company has elected to provide access to its proxy materials over the Internet. Accordingly, the Company is sending such Notice to the Company’s stockholders of record and beneficial owners. All stockholders will have the ability to access the proxy materials on the website referred to in the Notice or request to receive a printed set of the proxy materials. Instructions on how to access the proxy materials over the Internet or to request a printed copy may be found in the Notice. In addition, stockholders may request to receive proxy materials in printed form by mail or electronically by email on an ongoing basis. The Company encourages you to take advantage of the availability of the proxy materials on the Internet.

What does it mean if I receive more than one proxy card?

You may have multiple accounts at the transfer agent and/or with brokerage firms. Please sign and return all proxy cards, and provide your voting instructions, to ensure that all of your shares are voted for each of the proposals.

What if I change my mind after I return my proxy?

You may revoke your proxy and change your vote at any time before the polls close at the Annual Meeting. You may do this by:

| sending a written notice to the Secretary of the Company stating that you would like to revoke your proxy of a particular date; |

| signing another proxy card with a later date and returning it before the polls close at the Annual Meeting; |

| submitting a vote at a later time via Internet or telephone before the closure of those voting facilities at 11: |

| attending the Annual Meeting and voting in person. |

Please note, however, that if your shares are held of record by a brokerage firm, bank, broker dealer or other nominee, you must instruct your broker, bank, broker dealer or other nominee that you wish to change your vote by following the procedures on the voting form provided to you by the broker, bank, broker dealer or other nominee. If your shares are held in street name, and you wish to attend the Annual Meeting and vote at the Annual Meeting, you must bring to the Annual Meeting a legal proxy from the broker, bank, broker dealer or other nominee holding your shares, confirming your beneficial ownership of the shares and giving you the right to vote your shares.

Will my shares be voted if I do not sign and return my proxy card?

If your shares are held in street name or in your name and you do not sign and return your proxy card, or otherwise vote the shares via Internet or telephone, your shares will not be voted unless you vote in person at the Annual Meeting.

How are votes counted?

You may vote “For” or “Against” any proposal, or you may “Abstain” from voting on one or more proposals contained in the Proxy Statement. With respect to the advisory vote on the frequency of future advisory votes on executive compensation, you may vote for “one year”, “two years”, or “three years”. The inspector of elections appointed by the Company will tabulate the votes at the Annual Meeting.

How many votes are required to elect the nominated persons to the Board of Directors?

If a quorum is present at the Annual Meeting, an affirmative majority of the votes cast on the proposal is required to elect the nominees for director.

How many votes are required to ratify the Company’s independent registered public accountants?

If a quorum is present at the Annual Meeting, an affirmative majority of the votes cast on the proposal is required to ratify Freed Maxick CPAs, P.C. as the Company’s independent registered public accountants for the fiscal year ending December 31, 2012.2013.

How many votes are required to approve the amendments under eachexecutive compensation disclosed in this Proxy Statement of the Employee PlanCompany’s executive officers who are named in this Proxy Statement’s Summary Compensation Table, and Director Plan?with respect to the advisory vote on future advisory votes on executive compensation?

If a quorum is present

The advisory vote on executive compensation (Proposal 3) will not be binding on either the Board of Directors or the Company. However, the Company’s Compensation Committee will take into account the outcome of the stockholder vote on this proposal at the Annual Meeting an affirmative majoritywhen considering future executive compensation arrangements. In addition, your non-binding advisory votes described in Proposal 3 and below in Proposal 4 will not be construed (1) as overruling any decision by the Board of Directors, any Board committee or the Company relating to the compensation of the named executive officers or (2) as creating or changing any fiduciary duties or other duties on the part of the Board of Directors, any Board committee or the Company.

With regard to the advisory vote on the frequency of future advisory votes on executive compensation (Proposal 4), votes on the preferred voting frequency may be cast by choosing the option of one year, two years, three years, or “abstain” in response to this proposal. Votes cast on this proposal is not a vote to approve or disapprove the Board’s recommendation but rather is a vote to select one of the options described in the preceding sentence. The option of one year, two years or three years that receives the highest number of votes cast on these proposals is required to approveby stockholders will be the proposed amendments to eachfrequency of the Employee Planadvisory vote on executive compensation that has been recommended by the stockholders. However, because this vote is advisory and Director Plan.not binding on either the Board of Directors or the Company, the Board of Directors may subsequently decide that it is in the best interests of the Company and its stockholders to hold an advisory vote on executive compensation that differs in frequency from the option that received the highest number of votes from the Company’s stockholders at the Annual Meeting.

How many votes are required to approve other matters that may come before the stockholders at the Annual Meeting?

If a quorum is present at the Annual Meeting, an affirmative majority of the votes cast on any permitted proposal brought before the Annual Meeting is required for approval of such additional proposals.

What happens if I don’t indicate how to vote my proxy?

If you are a beneficial holder in street name and you just sign your proxy card without providing further instructions, your shares will not be voted in the election of directors, for the advisory vote on executive compensation, or for the proposals amending eachadvisory vote on the frequency of the Employee Plan and Director Plan.future advisory votes on executive compensation. Specific voting instructions are required in order for your nominee holder of record to vote on those proposals. On routine matters that permit discretionary voting, such as ratification of the Company’s independent registered public accountants, your shares may be voted on such matters by the nominee holder of record.

If you are a registered stockholder of record and you just sign your proxy card without providing further instructions, your shares will be voted by your proxy representative in the manner recommended by the Board.Board.

Is my vote kept confidential?

Proxies, ballots and voting tabulations identifying stockholders are kept confidential and will not be disclosed except as may be necessary to meet legal requirements.requirements.

Where do I find the voting results of the Annual Meeting?

We plan to announce preliminary voting results at the Annual Meeting. We will also file a Current Report on Form 8-K with the Securities and Exchange Commission within four business days of the Annual Meeting disclosing the final voting results.

Who can help answer my questions?

You can contact our corporate headquarters, at (585) 325-3610, or send a letter to: Investor Relations, Document Security Systems, Inc., 28 East Main Street, Suite 1525, Rochester, New York, 14614, with any questions about proposals described in this Proxy Statement or how to execute your vote.

DOCUMENT SECURITY SYSTEMS, INC.

28 EAST MAIN STREET, SUITE 1525

ROCHESTER, NEW YORK 14614

PROXY STATEMENT

SOLICITATION OF PROXIES

This Proxy Statement is furnished in connection with the solicitation of proxies by the Board of Directors of Document Security Systems, Inc. (the “Company”), for use at the Annual Meeting of Stockholders of the Company (the “Annual Meeting”) to be held at the Hyatt Regency Rochester, 125 East Main Street, Rochester, New York 14604 on Thursday, June 14, 2012,Tuesday, December 17, 2013, at 11:00 a.m. (Eastern Time) and at any adjournments or postponements thereof. Solicitation of proxies may be made by directors, officers and other employees of the Company. No additional compensation will be paid for any such services. This solicitation of proxies is being made by the Company which will bear all costs associated with the mailing of the proxy materials and the solicitation of proxies. Whether or not you expect to attend the Annual Meeting in person, and if you request and receive proxy materials by mail, please return your executed proxy card in the enclosed envelope and the shares represented thereby will be voted in accordance with your instructions. The Notice of Internet Availability of Proxy Materials (the “Notice”) will be mailed to all stockholders on May 4, 2012.by November 7, 2013. The proxy voting instructions accompanying the Notice describe the process for voting your shares via the Internet or by telephone. For stockholders who request mailings of the proxy materials, we will begin mailing the proxy materials to stockholders on or about MayNovember 15, 2012.2013.

REVOCABILITY OF PROXY

Any stockholder executing a proxy that is solicited has the power to revoke it prior to the voting of the proxy. Revocation may be made by attending the Annual Meeting and voting the shares of stock in person, or by delivering to the Secretary of the Company at the principal office of the Company prior to the Annual Meeting a written notice of revocation or a later-dated, properly executed proxy.

RECORD DATE

Stockholders of record at the close of business on April 17, 2012October 24, 2013 (the “Record Date”) will be entitled to vote at the Annual Meeting.

ACTION TO BE TAKEN UNDER PROXY

In the case of the Company receiving a signed proxy (“Proxy”) from a registered stockholder containing voting instructions “FOR” the election of each of the nominated directors , “FOR” Proposals 2 and “FOR” all3, and for “One Year” with respect to the proposals disclosed inadvisory vote on the Proxy Statement,frequency of future advisory votes on executive compensation, the persons named in the Proxy (David Wicker,(Robert Bzdick, Secretary of the Company, and Patrick White,Jeffrey Ronaldi, Chief Executive Officer of the Company), or either one of them who acts (the “Proxy Representative”), will vote:

| (1) | FOR the election of the persons named herein as nominees for directors of the Company; |

| (2) | FOR ratification of Freed Maxick CPAs, P.C. as the Company’s independent registered public accountants for the fiscal year ending December 31, |

| (3) | FOR approval of executive compensation disclosed in this Proxy Statement of the |

| (4) |

| (5) | According to their judgment on the transaction of such matters or other business as may properly come up for vote at the Annual Meeting or any adjournments or postponements thereof. |

If the giver of the Proxy provides voting instructions to cast a vote “AGAINST” any or all of the nominated directors or any of the proposals, or for “two years” or “three years” with respect to the frequency of future advisory votes on executive compensation, the Proxy Representative will vote such shares accordingly. If the giver of the Proxy provides voting instructions to “ABSTAIN” from voting on any or all of the above proposals, the Proxy Representative will abstain from voting the shares accordingly. For registered stockholders, if no specific voting instructions are given to the Proxy Representative, then the Proxy Representative will vote “FOR” Proposals 1, 2 and 3, andfor “one year” on Proposal 4, and according to their judgment on any other matters properly submitted for a vote at the Annual Meeting.

VOTING SECURITIES AND PRINCIPAL HOLDERS THEREOF

As of April 17, 2012,October 24, 2013, there were 20,738,80449,230,159 shares of Common Stock issued and outstanding, which constitute all of the outstanding capital stock of the Company entitled to vote. Stockholders are entitled to one vote for each share of Common Stock held by them.

A majority of the outstanding shares present in person or represented by proxy will constitute a “quorum” at the Annual Meeting. New York State law provides that directors be elected by the plurality of votes cast at a meeting of stockholders except as otherwise provided in the Company’s Certificate of Incorporation or By-Laws. The Company’s By-Laws, as amended, require the election of directors by an affirmative majority of the votes cast at the Annual Meeting on the proposal for election of directors. Under the Company’s By-Laws, as amended, the vote required for approval of all other proposals set forth in the Proxy Statement is an affirmative majority of the votes cast on each such proposal at the Annual Meeting. Proposal No. 3 and Proposal No. 4 are non-binding, as discussed below.

Abstentions from voting and broker non-votes will operate as neither a vote “FOR” nor a vote “AGAINST” a nominee for director under Proposal 1. In addition, abstentions and broker non-votes will operate as neither a vote “FOR” nor a vote “AGAINST” Proposals 3, andor as a vote for “one year, “two years” or “three years” with respect to Proposal No. 4 of this Proxy Statement. Absent specific voting instructions, nominee holders of record may vote “FOR” or “AGAINST” Proposal 2, or may “ABSTAIN” from voting on Proposal 2, but will not be permitted to vote on Proposals 1, 3 or 4. Votes on all matters will be counted by a duly appointed inspector of election, whose responsibilities are to ascertain the number of shares outstanding and the voting power of each, determine the number of shares represented at the Annual Meeting and the validity of proxies and ballots, count all votes and report the results to the Company.

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The following table sets forth beneficial ownership of Common Stock as of April 17, 2012October 24, 2013 by each person known by the Company to beneficially own more than 5% of the Common Stock, each director and nominee for election as a director, each of the executive officers named in the Summary Compensation Table (see “Executive and Management Compensation” below), and by all of the Company’s directors and executive officers as a group. As of April 17, 2012, no person other than Robert Fagenson owned 5% or more of the Company’s Common Stock. Each person has sole voting and dispositive power over the shares listed opposite his name except as indicated in the footnotes to the table and each person’s address is c/o Document Security Systems, Inc., 28 East Main Street, Suite 1525, Rochester, New York 14614.

| Name and Title of Beneficial Owner | Common Stock Beneficially Owned | Percentage of Outstanding Common Stock Beneficially Owned(1) | ||||||

| Patrick White, CEO and Director | 812,600 | 3.9% | ||||||

| David Wicker, VP of Research & Development and Director | 194,834 | (2) | Less than 1% | |||||

| Philip Jones, CFO | 180,000 | (3) | Less than 1% | |||||

| David Klein, Nominee for Director | 0 | 0% | ||||||

| Robert B. Fagenson, Director | 1,048,500 | (4) | 5.0% | |||||

| Ira A. Greenstein, Director | 39,000 | (5) | Less than 1% | |||||

| Roger O’Brien, Nominee for Director | 0 | 0% | ||||||

| Robert Bzdick, Director | 515,437 | 2.5% | ||||||

| John Cronin, Director | 0 | 0% | ||||||

| Alan Harrison, Director | 41,000 | (6) | Less than 1% | |||||

| Timothy Ashman, Director | 44,100 | (7) | Less than 1% | |||||

| All Executive Officers and Directors (11 persons) as a Group | 2,875,471 | (8) | 13.6% | |||||

The percentages of shares beneficially owned are based on 49,230,159 shares of our Common Stock issued and outstanding as of October 24, 2013, and is calculated by dividing the number of shares that person beneficially owns by the sum of (a) the total number of shares outstanding on October 24, 2013, plus (b) the number of shares such person has the right to acquire within 60 days of October 24, 2013.

| Name | Number of Shares Beneficially Owned | Percentage of Outstanding Shares Beneficially Owned |

| Robert Fagenson | 1,059,500 (1) | 2.2% |

| Jeffrey Ronaldi | 353,427 (2) | * |

| Peter Hardigan | 377,802 (3) | * |

| Robert B. Bzdick | 698,770 (4) | 1.4% |

| Jonathon Perrelli | 10,000 (5) | * |

| Ira A. Greenstein | 63,333(6) | * |

| David Klein | 28,333 (7) | * |

| Warren Hurwitz | 10,000 (5) | * |

| Philip Jones | 203,333 (8) | * |

| All officers and directors as a group (9 persons) | 2,804,498 | 5.6% |

| 5% Shareholders | ||

| Hudson Bay Master Fund Ltd. (9) | 5,058,233 | 9.99% |

* Less than1%.

(1) Includes 809,500 shares of the Company’s common stock, 50,000 shares of the Company’s common stock issuable upon the exercise of currently exercisable stock options, 100,000 shares of the Company’s common stock held by Mr. Fagenson’s wife, and an aggregate of 100,000 shares of the Company’s common stock held in trusts for Mr. Fagenson’s two adult children, of which Mr. Fagenson is trustee. Mr. Fagenson disclaims beneficial ownership of the 100,000 shares of the Company’s common stock held by his wife and the 100,000 shares of the Company’s common stock held in trusts for Mr. Fagenson’s two adult children. Does not include 20,000 options that will not vest within 60 days of October 24, 2013.

(2) Includes 90,025 shares of the Company’s common stock, 250,000 shares of the Company’s common stock issuable upon exercise of stock options within 60 days of October 24, 2013, and 13,402 shares of the Company’s common stock issuable upon exercise of warrants with an exercise price of $4.80. Does not include 750,000 options that will not vest within 60 days of October 24, 2013.

(3) Includes 109,123 shares of the Company’s common stock, 250,000 shares of the Company’s common stock issuable upon exercise of stock options within 60 days of October 24, 2013, and 18,679 shares of the Company’s common stock issuable upon exercise of warrants with an exercise price of $4.80. Does not include 750,000 options that will not vest within 60 days of October 24, 2013.

(4) Includes 515,437 shares of the Company’s common stock, and 183,333 shares of the Company’s common stock issuable upon the exercise of stock options within 60 days of October 24, 2013. Does not include 66,667 options that will not vest within 60 days of October 24, 2013.

(5) Includes 10,000 shares of the Company common stock issuable upon exercise of stock options. Does not include 20,000 options that will not vest within 60 days of October 24, 2013.

(6) Includes 63,333 shares of the Company’s common stock issuable upon exercise of stock options exercisable within 60 days of October 24, 2013. Does not include 56,667 options that will not vest within 60 days of October 24, 2013.

(7) Includes 28,333 shares of the Company’s common stock issuable upon the exercise of stock options within 60 days of October 24, 2013. Does not include 49,167 options that will not vest within 60 days of October 24, 2013.

(8) Includes 203,333 shares of the Company’s common stock issuable upon the exercise of options within 60 days of October 24, 2013. Does not include 66,667 options that will not vest within 60 days of October 24, 2013.

(9) To the best of our knowledge, the shareholder owns up to 2,542,105 shares of Common Stock issued to the shareholder on July 1, 2013, 1,402,800 shares of Common Stock issuable upon exercise of warrants at an exercise price of $4.80 issued to the shareholder on July 1, 2013 and 2,049,402 shares held in escrow by American Stock Transfer and Trust Company, LLC.(the “Escrow Shares”) issued to the shareholder on July 1, 2013. The warrants held contain a 9.99% beneficial ownership limitation. Hudson Bay Capital Management, L.P., the investment manager of Hudson Bay Master Fund Ltd., has voting and investment power over the securities held by Hudson Bay Master Fund Ltd.. Sander Gerber is the managing member of Hudson Bay Capital GP LLC, which is the general partner of Hudson Bay Capital Management, L.P. Sander Gerber disclaims beneficial ownership over these securities. These Escrow Shares will be released to shareholder if and when the closing price per share of the Company's Common Stock exceeds $5.00 per share (as adjusted for stock splits, stock dividends and similar events) for 40 trading days within a continuous 90 day trading period following July 1, 2013. If prior to July 1, 2014, such threshold is not achieved, the Escrow Shares will be canceled and returned to treasury.

SECTION 16(a) BENEFICIAL OWNERSHIP REPORTING COMPLIANCE

AND RELATED PERSON TRANSACTIONS

Section 16(a) Beneficial Ownership Reporting Compliance

Section 16(a) of the Exchange Act requires our executive officers and directors, and persons who beneficially own more than ten percent of our equity securities (“Reporting Persons”) to file reports of ownership and changes in ownership with the Securities and Exchange Commission. Based solely on our review of copies of such reports and representations from the Reporting Persons, we believe that during the fiscal year ended December 31, 2011,2012, all Reporting Persons were in compliance with the applicable requirements of Section 16(a) of the Exchange Act.

Transactions with Related Persons

On June 29, 2011, the Company used proceeds received from a commercial term note entered into with lender Neil Neuman to pay in full all sums owed under a credit agreement dated January 4, 2008, between the Company and Fagenson & Co., Inc. (“Fagenson & Co.”), as agent for certain lenders. The Fagenson & Co. credit agreement was terminated in its entirety on June 29, 2011 and the Company has no further obligations thereunder. Director Robert Fagenson was a principal of Fagenson & Co.

On August 22, 2011, the Company entered into a consulting agreement with Alan Harrison, then a member of the Company’s Board of Directors, for consulting services with respect to Secuprint Inc., a wholly-owned subsidiary of the Company. Mr. Harrison received a consulting fee of $9,000 per month during the term of the agreement which expired on December 31, 2011.

Robert Bzdick, who serves as both a director of the Company and as our Chief Operating Officer, is a member of Bzdick Properties, LLC.

On August 30, 2011, Premier Packaging Corporation (“PPC”), a wholly-owned subsidiary of the Company, entered into a purchase and sale agreement with Bzdick Properties, LLC, a New York limited liability company (“Bzdick Properties”), to purchase commercial real property in Victor, New York, for $1.5 million. The purchase price included a $150,000 subordinated promissory note from the Company to Bzdick Properties. Prior to the purchase, and since February 2010, PPC leased the property from Bzdick Properties under a lease at a rate of $13,333 per month. The promissory note to Bzdick Properties accrued interest at a rate of 9.5% per annum and matured on March 31, 2012, at which time the promissory note was paid-off in full, and Bzdick Properties was paid $150,000. Robert Bzdick, who serves as both a director and Chief Operating Officer of the Company and as our President, is a member of Bzdick Properties.Properties, LLC.

On February 20, 2012, the Company and ipCapital Group, Inc., a Delaware corporation (“ipCapital”), entered into an engagement letter (the “ipCapital Agreement”) for the provision of certain IP strategic consulting services by ipCapital. FeesUnder the terms of the ipCapital Agreement, fees payable for consulting services willwould range from $240,000 to $365,000 for the 2012 calendar year. In 2012, actual fees paid to ipCapital under the ipCapital Agreement totaled $325,000. In addition to cash fees, the Company issued ipCapital a five-year warrant to purchase up to 100,000 shares of the Company’s Common Stock at an exercise price of $4.62 per share. Also, on February 20, 2012, the Company entered into a three-year consulting arrangement with ipCapital for strategic advice on the development of the Company’s digital group infrastructure and cloud computing business strategy and issued ipCapital a five-year warrant to purchase up to 200,000 shares of the Company’s Common Stock at an exercise price of $4.50 per share in consideration therefor. The warrants vest and become exercisable as to one-third of the shares subject to the warrants on the first, second and third anniversary of the date of issuance. John Cronin, then a director of the Company, is Chairman, Managing Director and a 42% owner of ipCapital.

Effective on December 1, 2012, the Company entered into a consulting agreement with Patrick White, the Company’s former CEO. White will provide consulting services as requested by the Company, up to a maximum of 60 hours per month. Under the consulting agreement, White will be paid the sum of $14,167 per month from December 1, 2012 through February 28, 2014 and, thereafter, will be paid the sum of $11,667 per month for the remaining 12 months of the consulting agreement term.

PROPOSAL NO. 1 —

ELECTION OF DIRECTORS

INFORMATION ABOUT THE NOMINEES

The Company’s By-laws, as amended, currently specify that the number of directors shall be at least three and no more than eightnine persons, unless otherwise determined by a vote of the majority of the Board of Directors. The Company’s Board of Directors was expanded by an amendment to the Company’s By-laws adopted by the Board of Directors on January 16, 2012 from seven members to eight members. The Company’s By-laws provide that any vacancies on the Board of Directors may be filled by the remaining membersAll of the Board of Directors. Effective on February 21, 2012, John Cronin was appointed by the Board of Directors to fill the vacancy created by the January 16, 2012 By-laws amendment. First time nominees for election to the Board include David Klein and Roger O’Brien. Robert Fagenson, David Wicker, Patrick White, Robert Bzdick, Ira Greenstein and John Croninnamed below have been nominated by the Company to stand for election as incumbents. Current Board members Alan Harrison and Timothy Ashman have not be nominated for election at this year’s Annual Meeting, and their directorships will terminate effective on June 14, 2012. Each director of the Company serves for a one-year term (or until the next annual meeting of stockholders) or until such director’s successor is duly elected and qualified or until such director’s earlier resignation or removal.

On July 1, 2013, DSSIP, Inc., a Delaware corporation (“Merger Sub”) and a wholly-owned subsidiary of the Company merged with and into DSS Technology Management., Inc. (f/k/a Lexington Technology Group, Inc.), a Delaware corporation (“DSSTM”), pursuant to the terms and conditions of the previously announced Agreement and Plan of Merger, dated as of October 1, 2012, by and among the Company, DSSTM, Merger Sub and Hudson Bay Master Fund Ltd. (“Hudson Bay”), as representative of DSSTM’s stockholders (the “Merger”). Effective on July 1, 2013 (the “Closing Date”), as a result of the Merger, DSSTM became a wholly-owned subsidiary of the Company.

The board of directors of the Company following the Merger consists of eight (8) directors, four designated by DSSTM and four designated by the Company. Of the director nominees below, Messrs. Ronaldi, Hardigan, Perrelli, and Hurwitz were designated by DSSTM and have served as directors since the Closing Date of the Merger. In connection with the Merger, effective on the Closing Date, David Wicker, Roger O’Brien, and John Cronin resigned from the board of directors of the Company.

Biographical and certain other information concerning the Company’s directors and nominees for election to the Board is set forth below. There are no familial relationships among any of our directors or nominees. Except as indicated below, none of our directors is a director in any other reporting companies. None of our directors has been affiliated with any company that has filed for bankruptcy within the last ten years. We are not aware of any proceedings to which any of our directors, or any associate of any such director is a party adverse to us or any of our subsidiaries or has a material interest adverse to us or any of our subsidiaries.

BOARD NOMINEES

|  | |||

| Name | ||||

| Robert B. Fagenson | ||||

| Jeffrey Ronaldi | ||||

| Robert B. Bzdick | ||||

| Jonathon Perrelli | ||||

| Ira A. Greenstein | ||||

| David Klein | ||||

| Warren Hurwitz | ||||

The principal occupation and business experience for each executive officer and director nominee, for at least the past five years, is as follows:

Robert B. Fagenson spent the majority of his career at the New York Stock Exchange, where he was Managing Partner of one of the largest specialist firms operating on the exchange trading floor. Having sold his firm and subsequently retired from that business in 2007, he has since been the Chief Executive Officer of Fagenson & Co., Inc., a 50 year old broker dealer that is engaged in institutional brokerage as well as investment banking and money management. On March 1, 2012, Fagenson & Co., Inc. transferred its brokerage operations, accounts and personnel to National Securities Corporation and now operates as a branch office of that firm. On April 4, 2012, Mr. Fagenson was elected Chairman of the Board of National Holdings Corporation which is the parent of National Securities Corporation, a full line broker dealer with offices around the United States.

During his career as a member of the New York Stock Exchange beginning in 1973, Mr. Fagenson has served as a Governor on the trading floor and was elected to the NYSE Board of Directors in 1993, where he served for six years, eventually becoming Vice Chairman of the Board in 1998 and 1999. He returned to the NYSE Board in 2003 and served as a director until the Board was reconstituted with only non-industry directors in 2004.

Mr. Fagenson has previously served on the boards of a number of public companies and is presently the Non-Executive Chairman of the Board of Directors of Document Security Systems, Inc. He has served as a director for the Company since 2004, and as the Board’s Non-Executive Chairman since 2008. He is also a member of the Board of Directors of Cash Technologies Corp., and is also a Director of the National Organization of Investment Professionals (NOIP).

In addition to his business related activities, Mr. Fagenson serves as Vice President and a director of New York Services for the Handicapped, Treasurer and director of the Centurion Foundation, Director of the Federal Law Enforcement Officers Association Foundation, Treasurer and director of the New York City Police Museum and as a member of the Board of the Sports and Arts in Schools Foundation. He is a member of the alumni boards of both the Whitman School of Business and the Athletic Department at Syracuse University. He also serves in a voluntary capacity on the boards and committees of many civic, social and community organizations. Mr. Fagenson received his B.S. degree in Transportation Sciences & Finance from Syracuse University in 1970.

Patrick WhiteJeffrey Ronaldi founded the Company in 2002, and since 2002, has served has as the Company’s Chief Executive Officer and director since the closing of the Merger on July 1, 2013. Mr. Ronaldi had previously served as DSSTM’s Chief Executive Officer since November 9, 2012. He also has served since July 2011 as Managing Director at HPR Capital, LLC; since January 2008 he has also served as Managing Partner of CTD Group, LLC and since June 2005, he has served as Managing Director of SSL Services, LLC. From November 2008 to November 2010, he served as Chief Executive Officer at Turtle Bay Technologies, an intellectual property management firm that provides strategic capital, asset management services and guidance for intellectual property owners. Since August 2008, Mr. Ronaldi has provided consulting services to Juridica Investments Ltd., a director. Underclosed-end investment fund listed on the Alternative Investment Market (AIM) of the London Stock Exchange. Mr. White’s leadership and direction, from 2007 through 2011 the Company was named to the “Technology Fast 500” list, which is a list published by Deloitte LLP for the fastest growing technology companies in the United States. Mr. White, a forward-thinking, results driven security technology industry executive, brings over 25 years of private and public company operating, financial,Ronaldi’s experience with Turtle Bay Technologies and management experienceof intellectual property qualifies him to the Company. He has extensive experience building successful organizations through combining his expertise in strategic planning, capital raising, product design and development including several patents he co-authored as well as sales and marketing, mergers and acquisitions, and operations management. In addition to his service as aserve on our board member for the Company, Mr. Whiteof directors.

Peter Hardigan has served onas the Board of Directors of Internet Media Services, Inc.Company’s Chief Operating Officer and director since October 2009, and is a frequent speaker at industry functions. Mr. White also serves on the Board of Directors of Reliance Funding Group Inc., a regional boutique investment banking firm, having been appointed to that board in 2011. Previously, Mr. White held executive and financial positions at Rochester Community Savings Bank (now RBS Citizens, N.A.), and has owned and operated several print manufacturing companies and is an active memberclosing of the U.S. Secret Services, Document Security Alliance which is tasked with recommending security technologies to protect the vital records of the United States and state governments.Merger on July1, 2013. Mr. White received his Bachelors of Science degree in AccountingHardigan had previously served as DSSTM’s Chief Operating Officer and a Masters of Business Administration from the Rochester Institute of Technology.

David Wicker joined our Company as Vice President of Operations in August 2002 and was named a director in December 2007. Mr. Wicker currently serves as Vice President of Research & Development for the Company, directing the technical operations behind our patented document security technologies. Mr. Wicker has authored and co-authored several patents and patent applications in the anti-counterfeiting field. Mr. Wicker is an active member of the Document Security Alliance, Center for Identity Management and Information Protection, the Association of Certified Fraud Examiners, and the U.S. Chamber of Commerce CACP Counterfeiting Coalition.since inception. Prior to joining DSSTM, from August 2011 to August 2012, Mr. Hardigan was the Company,Chief Financial Officer and Head of Investment Management at IP Navigation Group, LLC (IPNav), where he was responsible for financial assessment of IPNav portfolio acquisitions. From September 2007 to August 2011, Mr. Wicker consultedHardigan was Principal at Charles River Associates in New York and Frankfurt, where he represented a range of Fortune 500 Companies and institutional investors involved in IP monetization. Prior to joining Charles River Associates, from February 2005 to September 2007, Mr. Hardigan was a licensing officer at Columbia Technology Ventures, where he was responsible for banknoteevaluation, commercial development and security printerslicensing of CTV’s life sciences portfolio. Prior to CTV, from April 1999 to July 2003, Mr. Hardigan was a strategy consultant at Mainspring and developed several security technologies in use worldwide today.

With his 32 yearsIBM Business Consulting Services (following IBM’s acquisition of printingMainspring) where he advised Fortune 500 life sciences, financial services, and consumer goods firms, with a focus on portfolio strategy and business development. Mr. Hardigan holds an MBA from Columbia University and a B.A. from the University of Chicago. Mr. Hardigan’s experience including 22 years specializing in security printing, Mr. Wicker has established himselfand leadership as an industry expertexecutive officer and director of DSSTM and experience in the field of anti-counterfeiting. In additionintellectual property monetization qualify him to his active membership in various anti-counterfeiting organizations and standard setting boards, Mr. Wicker leads a research team that holds several US and international patents that form the basis of several ofserve on the Company’s products. Mr. Wicker is integral to business development efforts, especially in regards to licensing and custom security products and projects, and has relationships with leading security printers.board of directors.

Robert B. Bzdick joined the Company on February 17, 2010 as Chief Operating Officer after the Company’s acquisition of its wholly-owned subsidiary, Premier Packaging Corporation, for which Mr. Bzdick was the Chief Executive Officer. Mr. Bzdick became a director of the Company in March 2010.2010and Chief Executive Officer in December 2012. Mr. Bzdick resigned as Chief Executive Officer of the Company and was appointed President of the Company on July 1, 2013. Prior to founding Premier Packaging Corporation in 1989, Mr. Bzdick held positions of Controller, Sales Manager, and

General Sales Manager at the Rochester, New York division of Boise Cascade, LLC (later Georgia Pacific Corporation). Mr. Bzdick has over 29 years of experience in manufacturing and operations management in the printing and packaging industry.

Mr. Bzdick brings his considerable packaging and printing industry experience to the Company. Mr. Bzdick serves

Jonathon Perrelli has served as the Chief Operating Officera director of the Company since the closing of the Merger on July 1, 2013. Mr. Perrelli is the Founder of Fortify Ventures LLC, a position that will continueseed and early stage venture fund, and has served as Managing Director since May 2011. Mr. Perrelli is the Founder of SecureForce, LLC, or SecureForce, a cyber-security solutions provider serving the United States Department of Defense and Intelligence, and served as President and Chief Executive Officer from December 2003 until December 2012. Since January 2011, Mr. Perrelli has served as the Chairman of the Board of SecureForce. In addition to be integralSecureForce, Mr. Perrelli currently serves as a director of Inertial Labs Inc. and Venga, Inc. Mr. Perrelli’s experience and leadership as an executive officer and director in technology and security companies qualify him to serve on the Company’s growth as the Company continues to integrate its production and processes between the Company’s printing, paper and packaging facilities. In addition, Mr. Bzdick is involved in business development for the Company’s secure packaging initiatives.board of directors.

Ira A. Greenstein is President of Genie Energy Ltd., an energy services company. Prior to joining Genie Energy Ltd. in December 2011, Mr. Greenstein served as President of IDT Corporation (NYSE: IDT), a provider of wholesale and retail telecommunications services.services and continues to serve as counsel to the Chairman. Prior to joining IDT in January 2000, Mr. Greenstein was a partner in the law firm of Morrison & Foerster LLP from February 1997 to November 1999, where he served as the chairman of the firm’s New York Business Department. Concurrent to his tenure at Morrison & Foerster, Mr. Greenstein served as General Counsel and Secretary of Net2Phone, Inc. from January 1999 to November 1999. Prior to 1997, Mr. Greenstein was an associate in the New York and Toronto offices of Skadden, Arps, Meagher & Flom LLP. Mr. Greenstein also served on the Securities Advisory Committee to the Ontario Securities Commission from 1992 through 1996. From 1991 to 1992, Mr. Greenstein served as secondment counsel to the Ontario Securities Commission. Mr. Greenstein currently serves on the Boardboards of AdvisorsOhr Pharmaceutical, Inc., NanoVibronix Inc., Regal Bank of New Jersey and Arista Power, Inc. Mr. Greenstein is a member of the Dean’s Council of the Columbia Law School Center on Corporate Governance. Mr. Greenstein received a B.S. from Cornell University and a J.D. from Columbia University Law School. Mr. Greenstein was appointed to our Board of Directors in September 2004.

Mr. Greenstein provides the Company with significant public company management experience, particularly in regards to legal and corporate governance matters, mergers and acquisitions, and strategic planning. In addition, Mr. Greenstein’s extensive legal experience has provided the Company insights and guidance throughout the Company’s patent litigation initiatives.

John Cronin was appointed to our Board of Directors in February 2012. Mr. Cronin is Managing Director and Chairman of ipCapital Group, Inc., a Delaware corporation (ipCG), and has served in that capacity since 1998. Prior thereto, Mr. Cronin spent 17 years at IBM with over 100 patents and 150 patent publications. Mr. Cronin created and ran the IBM Patent Factory and was part of the team that contributed to the start of and success of IBM’s licensing program. Mr. Cronin serves as a member of the Boards of Directors of Vermont Electric Power Company, Armor Designs, Inc., GraphOn Corporation, ImageWare Systems, Inc., and Primal Fusion, Inc., and is also a member of the advisory boards for InnoPad, Inc. and VirnetX Holding Corporation. Mr. Cronin holds a BSEE, an MSEE, and a BA in Psychology from the University of Vermont.

Roger O’Brienis President of O’Brien Associates, LLC, a general management consulting firm providing advisory and implementation services to managements in a variety of competitive industries, with special focus on interim general management, technology commercialization, marketing and strategy development. The firm was founded in 1999 and has offices in Rochester, New York and Santa Fe, New Mexico. Mr. O’Brien’s background includes serving as Chief Operating Officer of Ultralife Batteries, Inc. a publicly-held manufacturer of advanced battery power sources, and as an officer of Sun Microsystems, Inc. during a period in the late 1980’s when the company grew from $500 million to $2 billion in sales over a 24-month period. Mr. O’Brien is a member of the Board of Directors of Odyssey Software, Inc. and Bristol ID Technologies, Inc. He also serves as an adjunct professor for the Human Resources Development graduate school program at Rochester Institute of Technology. Mr. O’Brien holds a Bachelor of Science degree in Nuclear Engineering from New York University and a MBA from The Wharton School, University of Pennsylvania.

David Kleinhas served as is Senior Vice President, Treasurer of& Controller for Constellation Brands, Inc., a Delaware corporation, (NYSE:STZ). Mr. Klein, who has been with Constellation since March 2009. From September 2004, until March 2009, Mr. Kleinhas also served in the capacities of Vice President, Business Development and Chief Financial Officer of Constellation Europe, for Constellation Brands. In his current role,Europe. Mr. Klein is responsible for the quantitative management of risk, improving company-widecompany’s $7B debt portfolio, overall capital structure and cash flow generationmanagement, accounting, external and internal reporting, currency and commodity risk management, and the management of capital structure.global financial shared service center. At Constellation, Mr. Klein’s previous contributions at Constellation Brands include leadKlein has held leading roles inon several domestic and international acquisitions, divestitures and divestitures,

as well as conceptualizing and executing Constellation’s United Kingdom distribution joint venture.ventures. Preceding his tenure at Constellation Brands, Mr. Klein was Chief Financial Officer at Montana Mills Bread Co., Inc., a Delaware corporation(NYSE:MMX) where he was involved withworked the transformationtransition from private to public company and the subsequent sale of Montana Mills Bread Co., Inc., to Krispy Kreme Doughnuts Inc. Mr. Klein holds a Bachelor’s Degree in Economics from SUNY Geneseo and a MBA from SUNY Buffalo.

Mr. Klein and Mr. O’Brien are first time nominees for election to the Company’s Board, and have been selected by the Board for the breadthhas served as a director of experience they offer the Company since June 2013.

Warren Hurwitzhas served as a director of the Company since the closing of the Merger on July 1, 2013. Mr. Hurwitz has served since March 2005 as a partner of Altitude Capital Partners, a private investment fund that he co-founded that is focused on investing in, enforcing and protecting the areasrights of strategic marketingintellectual property assets. Prior to Altitude Capital Partners, Mr. Hurwitz was a Senior Vice President at HSBC Capital (USA), the U.S. private equity arm of HSBC Group, from May 2001 through June 2004 and fiscal planning,has held various positions within HSBC Markets (USA) Inc. from June 1994 through May 2001. Mr. Hurwitz received his B.A. degree in Economics from the State University of New York at Albany and for their proven track recordhis MBA from Fordham University. Mr. Hurwitz’s experience with Altitude Capital Partners and the investment, enforcement and protection of success in developing and executing complex and effective corporate strategies during their respective professional careers.intellectual property rights qualify him to serve on our board of directors.

There are no legal proceedings that have occurred within the past ten years concerning our directors or nominees which involved a criminal conviction, a criminal proceeding, an administrative or civil proceeding limiting one’s participation in the securities or banking industries, or a finding of securities or commodities law violations.

RECOMMENDATION OF THE BOARD FOR PROPOSAL NO. 1:

THE BOARD OF DIRECTORS RECOMMENDS A VOTE FOR EACHTHE ELECTION OF

ALL THE NOMINEES FOR DIRECTOR.DESCRIBED ABOVE.

INFORMATION CONCERNING BOARD OF DIRECTORS

Compensation of Directors

Each independent director (as defined under Part 1, Section 803 of the NYSE AmexMKT LLC Company Guide) is currently entitled to receive base cash compensation of $12,000 annually, provided such director attends at least 75% of all Board of Director meetings, and all scheduled committee meetings. Each independent director is entitled to receive an additional $1,000 for each Board of Director meeting he attends, and an additional $500 for each committee meeting he attends, provided such committee meeting falls on a date other than the date of a full Board of Directors meeting. The independent director who serves as chairman of the board’s Audit Committee is entitled to receive additional compensation of $6,000 per year. The independent directors who serve as chairman of each of the board’s Compensation and Management Resources Committee and Nominating and Corporate Governance Committee is entitled to receive additional compensation of $3,000 per year. Each of the independent directors is also entitled to receive discretionary grants of options or restricted stock under the Company’s Employee, Director and Consultants Equity Incentive Plan.

During the year ended December 31, 2012, our independent director compensation policy was as follows.Each independent director (as defined under Section 803 of the NYSE MKT LLC Company Guide) was entitled to receive $12,000 per year in cash compensation soon after the end of each fiscal year, so long as the director attended at least 75% of the Board of Director meetings during such fiscal year, as well as reimbursement for travel expenses. The independent director serving as Chairman of the Board was entitled to receive $36,000 in cash compensation. Non-independent members of the Board of Directors dodid not receive cash compensation in any form, except for reimbursement of travel expenses. In order to attract and retain qualified persons to our Board, in January 2004, we established the Director PlanCompany maintained a non-executive director stock option plan (the “Director Plan”) which providesprovided for the grant of five-year options to purchase Common Stockour common stock at 100% of fair market value at the date of grant. Under the Director Plan, each non-executive director receivesreceived an option to purchase 5,000 shares of Common Stockthe Company’s common stock upon becoming a Board member and 5,000 shares at the beginning of each year thereafter while serving as a director plus an additional option to purchase 1,000 shares for each year (or portion thereof, on a pro rata basis) of service on the Board, up to a maximum of 10,000 shares annually.

Director Compensation

The following table shows 2011sets forth cash compensation and the value of ourstock options awards granted to the Company’s non-employee independent directors. Employee directors do not receive compensation for their service on the Board of Directors:in 2012:

| Name | Fees Earned or Paid in Cash | Stock Awards | Option Awards(1) | Non-Equity Incentive Plan Compensation | Total | Fees Earned or Paid in Cash | Stock Awards | Option Awards (1) | Total | |||||||||||||||||||||||||||

| ($) | ($) | ($) | ($) | ($) | ($) | ($) | ($) | ($) | ||||||||||||||||||||||||||||

| Timothy Ashman | 12,000 | — | 21,200 | — | 33,200 | |||||||||||||||||||||||||||||||

| Robert B. Fagenson | 36,000 | — | 21,200 | — | 57,200 | 36,000 | — | 9,900 | 45,900 | |||||||||||||||||||||||||||

| Ira A. Greenstein | 12,000 | — | 21,200 | — | 33,200 | 12,000 | — | 57,500 | 69,500 | |||||||||||||||||||||||||||

| Alan E. Harrison | 12,000 | — | 21,200 | — | 33,200 | |||||||||||||||||||||||||||||||

| David Klein (2) | 7,000 | — | 55,650 | 62,650 | ||||||||||||||||||||||||||||||||

| John Cronin (3) | 10,000 | — | 8,050 | 18,050 | ||||||||||||||||||||||||||||||||

| Roger O’Brien (4) | 7,000 | — | 27,450 | 34,450 | ||||||||||||||||||||||||||||||||

| Alan Harrison (5) | — | — | 9,900 | 9,900 | ||||||||||||||||||||||||||||||||

| Timothy Ashman (6) | — | — | 9,900 | 9,900 | ||||||||||||||||||||||||||||||||

| (1) | Represents the total grant date fair value of option awards computed in accordance with FASB ASC 718. Our policy and assumptions made in the valuation of share-based payments are contained in Note 7 to our financial statements for the year ended December 31, |

| (2) | Mr. Klein was elected as a director of the Company on June 14, 2012. |

| (3) | Mr. Cronin was appointed as a director of the Company on February 21, 2012. Mr. Cronin resigned as a director on July 1, 2013. |

| (4) | Mr. O’Brien was elected as a director of the Company on June 14, 2012. Mr. O’Brien resigned as a director on July 1, 2013. |

| (5) | Mr. Harrison’s service as a director of the Company terminated on June 14, 2012. |

| (6) | Mr. Ashman’s service as a director of the Company terminated on June 14, 2012. |

Board of Directors and Committees

The Board of DirectorsCompany has determined that each of the following nominees for election to the Company’s Board of Directors,directors, Messrs. O’Brien,Hurwitz, Fagenson, Greenstein, CroninPerrelli and Klein, qualify as an independent director (as defined under Section 803 of the NYSE Amex LLC Company Guide). Each of Timothy Ashman and Alan Harrison, who have not been nominated for re-election to the Board, and whose present directorship terms will expire on June 14, 2012, are independent directors (as defined under Section 803 of the NYSE AmexMKT LLC Company Guide).

In fiscal 2011,2012, each of the Company’s incumbent directors attended or participated in 75% or more of the aggregate of (i) the total number of meetings of the Board of Directors held during the period in which each such director served as a director and (ii) the total number of meetings held by all committees of the Board of Directors during the period in which each such director served on such committee. During the fiscal year ended December 31, 2011,2012, the Board held threefive meetings and acted by written consent on seven occasions, the Audit Committee held three meetings, the Compensation Committee held two meetings, and the Nominating and Corporate Governance Committee held one meeting. During the fiscal year ended December 31, 2011, thenine occasions. The Board’s independent directors met in executive session on one occasion outside the presence of the non-independent directors and management.

Directors are encouraged to attend the Company’s annual meetings of stockholders, and the Company generally schedules a meeting of the Board of Directors on the same date and at the same place as the annual meeting of stockholders to encourage director attendance. All of the directors constituting the Board of Directors at the time of the 2011 Annual Meeting of Stockholders attended the 2011 Annual Meeting of Stockholders in person.

Audit Committee

The Company has separately designated an Audit Committee established in accordance with Section 3(a)(58)(A) of the Securities Exchange Act of 1934.1934, as amended (the “Exchange Act”). The Audit Committee held four meetings in 2012. The Audit Committee is responsible for, among other things, the appointment, compensation, removal and oversight of the work of the Company’s independent registered public accounting firm, overseeing the accounting and financial reporting process of the Company, and reviewing related person transactions. During his currentmost recent term as a member of the Company’s Board of Directors, which term will expireexpired on June 14, 2012, Timothy Ashman has served as Chairman of the Audit Committee of the Board and qualified as a “financial expert” as defined in Item 407 under Regulation S-K of the Securities Act of 1933. The Audit Committee is currently comprised of Timothy Ashman,David Klein, its Chairman, Robert Fagenson and Ira Greenstein. ItWarren Hurwitz. David Klein is the intentionqualified as a “financial expert” as defined in Item 407 under Regulation S-K of the Board to appoint another Audit Committee member at its Board meeting to be held on June 14, 2012, to replace Timothy Ashman.Securities Act of 1933, as amended. Each of the members of thisthe Audit Committee is an independent director (as defined under Section 803 of the NYSE AmexMKT LLC Company Guide). The Audit Committee operates under a written charter adopted by the Board of Directors, which can be found in the Corporate Governance section of our web site, www.dsssecure.com.

www.dsssecure.com, and is also available in print to any stockholder upon request to the Corporate Secretary.

Compensation and Management Resources Committee

The purpose of the Compensation and Management Resources Committee is to dischargeassist the Board’sBoard in discharging its responsibilities relating to executive compensation, succession planning for the Company’sCompany's executive team, and to review and make recommendations to the Board regarding employee benefit policies and programs, incentive compensation plans and equity-based plans. The Compensation and Management Resources Committee held one meeting in 2012.

The Compensation and Management Resources Committee is responsible for, among other things, (a) reviewing all compensation arrangements for the executive officers of the Company and (b) administering the Company’s stock option plans. During his currentmost recent term as a member of the Company’s Board of Directors, which term will expireexpired on June 14, 2012, Alan Harrison has served as Chairman of the Compensation and Management Resources Committee of the Board. The Compensation and Management Resources Committee currently consists of Ira Greenstein, its Chairman, Robert Fagenson, Alan Harrison and Ira Greenstein. It is the intention of the Board to appoint another member to its Compensation and Management Resources Committee at its Board meeting to be held on June 14, 2012, to replace Alan Harrison.Jonathon Perrelli. Each of the members of the Compensation and Management Resources Committee is an independent director (as defined under Section 803 of the NYSE AmexMKT LLC Company Guide). The Compensation and Management Resource Committee operates under a written charter adopted by the Board of Directors, which can be found in the Corporate Governance section of our web site,www.dsssecure.com, and is also available in print to any stockholder upon request to the Corporate Secretary. www.dsssecure.com.

The duties and responsibilities of the Compensation and Management Resources Committee in accordance with its charter are to review and discuss with management and the Board the objectives, philosophy, structure, cost and administration of the Company’sCompany's executive compensation and employee benefit policies and programs; no less than annually, review and approve, with respect to the Chief Executive Officer and the other executive officers (a) all elements of compensation, (b) incentive targets, (c) any employment agreements, severance agreements and change in control agreements or provisions, in each case as, when and if appropriate, and (d) any special or supplemental benefits; make recommendations to the Board with respect to the Company’sCompany's major long-term incentive plans, applicable to directors, executives and/or non-executive employees of the Company and approve (a) individual annual or periodic equity-based awards for the Chief Executive Officer and other executive officers and (b) an annual pool of awards for other employees with guidelines for the administration and allocation of such awards; recommend to the Board for its approval a succession plan for the Chief Executive Officer, addressing the policies and principles for selecting a successor to the Chief Executive Officer, both in an emergency situation and in the ordinary course of business; review programs created and maintained by management for the development and succession of other executive officers and any other individuals identified by management or the Compensation and Management Resources Committee; review the establishment, amendment and termination of employee benefits plans, review employee benefit plan operations and administration; and any other duties or responsibilities expressly delegated to the Compensation and Management Resources Committee by the Board from time to time relating to the Committee’sCommittee's purpose.

The Compensation and Management Resources Committee may request any officer or employee of the Company or the Company’sCompany's outside counsel to attend a meeting of the Compensation and Management Resources Committee or to meet with any members of, or consultants to, the Compensation and Management Resources Committee. The Company’sCompany's Chief Executive Officer does not attend any portion of a meeting where the Chief Executive Officer’sOfficer's performance or compensation is discussed, unless specifically invited by the Compensation and Management Resources Committee.

The Compensation and Management Resources Committee has the sole authority to retain and terminate any compensation consultant to be used to assist in the evaluation of director, Chief Executive Officer or other executive officer compensation or employee benefit plans, and shall have sole authority to approve the consultant’sconsultant's fees and other retention terms. The Compensation and Management Resources Committee also has the authority to obtain advice and assistance from internal or external legal, accounting or other experts, advisors and consultants to assist in carrying out its duties and responsibilities, and has the authority to retain and approve the fees and other retention terms for any external experts, advisors or consultants.

Nominating and Corporate Governance Committee